今日推荐开源项目:《正则表达式 learn-regex》

今日推荐英文原文:《Don’t Bet on AI (yet)》

今日推荐开源项目:《正则表达式 learn-regex》传送门:GitHub链接

推荐理由:正则表达式,在处理复杂的用户输入时强大的助力,但是学习它的时候各种符号的组合能把你的思维绕到三百万年外。这个项目是一个关于正则表达式的教程,不仅收录了学习资料,还提供了一个在线的学习网站帮助巩固所学,在实操中多练习一下能够让你更快的达到不需要每次使用的时候都翻开教程的境界,熟能生巧,这种东西还是全记下来用的才方便。

今日推荐英文原文:《Don’t Bet on AI (yet)》作者:AJ Christensen

原文链接:https://towardsdatascience.com/dont-bet-on-ai-yet-c3c37bbcc0b6

推荐理由:成功并非唾手可得,人工智能也是如此

Don’t Bet on AI (yet)

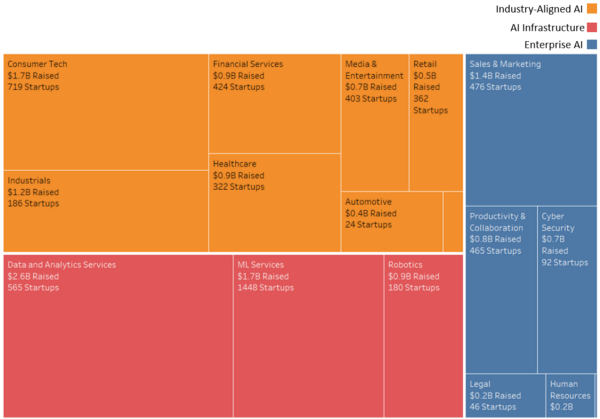

I’ve analyzed 7,000 “AI Startups”. Most underestimate the challenges that plague AI. Does yours?

You’ve probably heard some variation of this quote from Andrew Ng: “AI is the new electricity! Electricity transformed countless industries; AI will now do the same.” I agree with this sentiment, mostly. The problem is, this statement ignores the massive obstacles that are preventing rapid AI adoption. AI will not be an overnight phenomenon. It took more than 40 years for electricity to become a ubiquitous technology! The world had already discovered the key elements of modern electricity by 1882. Many challenges, however, prevented instant mass adoption: costly infrastructure, lack of talent, opaque regulations, and more. Taken together, these obstacles kept electricity out of the average US home until 1925!AI is the new electricity. It will transform industries. But like electricity, it will take decades. Today is 1882 in the world of AI, not 1925.What frictions are preventing AI adoption? Where will AI succeed first? Where will it lag? Unless we develop this conversation, many technologically viable, well-reasoned AI ventures will fail. This matters because the world, perhaps unwisely, is betting big on AI right now. I scraped the web and found 7,192 “AI Startups” — ventures that claim they are an AI company or say they’re using machine learning. These startups have raised more than $19B and employ well over 150,000 employees.

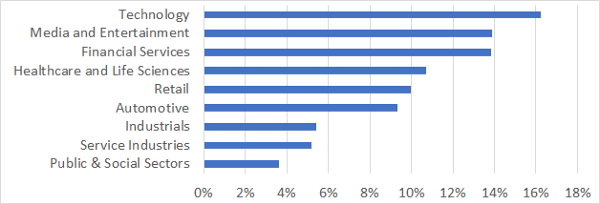

AI Venture Activity by Market | Source: Analysis of 7,192 “AI Startups” from Angel List

AI Venture Activity by Market | Source: Analysis of 7,192 “AI Startups” from Angel List

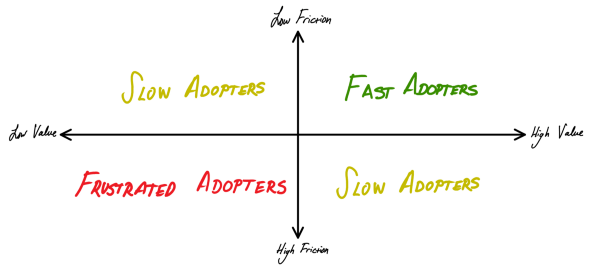

When Will Your AI Venture Succeed? — A Framework

Fortunately, you can predict whether your AI venture is more likely to succeed in the near, medium, or long term. The capabilities and challenges of AI are well understood — all you have to do is review them holistically, then think critically about your use case for AI. To do this, consider using a simple framework: the rate at which your AI solution will be adopted is a function of the value potential and unique frictions therein. There are many frictions that slow down AI adoption. But these frictions slow some ventures more than others. Why? Because some AI solutions create more value than others. When an AI solution has dramatic value potential, companies, investors, regulators, and consumers more easily align to push through friction. This simple relationship between value and friction yields a useful framework: Rate of AI Adoption = f(AI friction, AI value)

So what does the road to mass adoption look like for your AI bet? This framework can be operationalized in a straightforward manner for any problem, venture, or industry. Here’s a more detailed breakdown.

Rate of AI Adoption = f(AI friction, AI value)

So what does the road to mass adoption look like for your AI bet? This framework can be operationalized in a straightforward manner for any problem, venture, or industry. Here’s a more detailed breakdown.

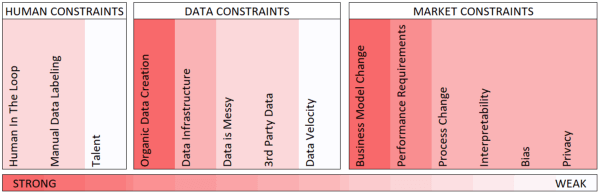

Top Frictions Preventing Rapid AI Adoption

Step one is to perform a thoughtful analysis of the AI frictions that might slow adoption for your AI venture. Human, data, and market frictions all slow the adoption of proven AI solutions. They complicate development, limit scalability and introduce use-case killing risks. And not all frictions are created equal. Some are much more dangerous than others: Estimated Magnitude of AI Frictions | Source: Interviews with AI Experts

Estimated Magnitude of AI Frictions | Source: Interviews with AI Experts

Human Constraints on AI

- Human-in-the-loop requirements: Many algorithms need human supervision. For example, Facebook employs more than 15,000 people to assist their content moderation algorithms.

- Manual data labeling requirements: Many use-cases for AI need humans to teach algorithms what to predict (or in technical terms, “label” the data). For example, Baidu had to hire thousands of translators to train its Chinese translation algorithms.

- Lack of access to talent: There is a global shortage of data scientists, machine learning engineers, and other AI talent. This makes it challenging for companies to assemble competent AI teams. In 2018, Indeed.com had 3X more postings than searches for AI-related jobs.

Data Constraints on AI

- Organic data creation: Some business models don’t naturally generate the data that AI requires. For example, traditional retail businesses don’t capture rich data on customer shopping patterns. To incorporate AI retailers need to adopt new business models, such as online and ‘direct to consumer’.

- Lacking Data Infrastructure: AI requires significant investment at every level of the technology stack. On-prem hardware and legacy software solutions are anathemas to AI. To enable AI, enterprises have to invest in cloud, data centralization, data security, and AI development tools.

- Existing data is messy: Data is rarely organized in clean, centralized tables of rows and columns. Instead, most data lives in messy documents or legacy software systems. Companies tend to silo data across teams and organizations. They typically fail to maintain documentation for where different data exists. And they don’t enforce standards for how to capture and store their data.

- Dependence on 3rd party data: AI is hungry for data. When your company doesn’t have enough proprietary data, it has to buy it. Licensing and maintaining APIs to access 3rd party data is costly.

- Data velocity is low: Most AI requires thousands of examples of completed feedback loops to learn. This is challenging in areas with slow feedback loops. For example, capturing data on long-term health care outcomes for chronic illnesses is a costly process.

Market Constraints on AI

- Business model changes required to capture AI value: To capture AI value, many industries will have to change how they deliver products and services. For example, autonomous vehicles will force automakers to embrace transportation-as-a-service strategies.

- Near-perfect algorithm performance requirements: Some AI use cases have a high cost of failure. Take, for example, diagnostic decisions in healthcare or self-driving cars. In these contexts, AI solutions introduce significant risks.

- AI requires process change: AI-enabled products often introduce drastically different workflows. For example, AI-powered recruiting solutions often prefer non-traditional interviews and job applications. This scares more traditional HR teams.

- Uninterpretable algorithms: In many instances, consumers (and even regulators) demand AI-tools that can explain themselves. Unfortunately, it’s very difficult to interpret how many AI algorithms make decisions. For example, if a bank denies a client credit they have to explain why. This makes AI in lending difficult.

- Biased algorithms: AI algorithms often make biased decisions. This is illegal and distasteful in many areas (such as law enforcement, HR, and education).

- Onerous privacy standards: AI is a threat to privacy. AI creates incentivizes for companies to collect vast amounts of private information. Additionally, AI is capable of inferring personal information (like an individual’s emotional state) from innocuous data (like typing patterns). AI solutions that threaten privacy are likely to face regulatory and consumer resistance.

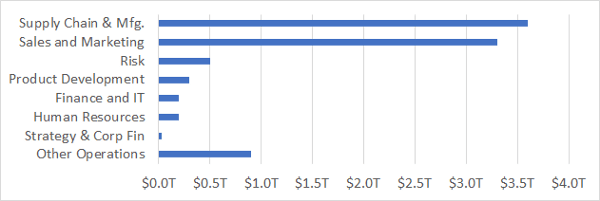

Sizing the Value of AI

Once you understand the AI frictions facing your venture, perform a value analysis. Does your AI solution reduce costs? Save time? Mitigate risk? Create new consumer value? If so, how much? There is no one-size-fits-all approach for doing this. Once you’ve valued your AI solution, think critically about how well this value will motivate stakeholders to push past friction. In doing this, you should consider macro-level trends. It’s dangerous to be in a category where AI is not creating significant value more generally. If that’s the case, you’ll be a lonely advocate for AI. McKinsey Global Institute (MGI) recently valued the potential of AI and analytics at more than $9T. Importantly, this value is not distributed proportionally across various use-cases and industries.Use cases for AI

After valuing a list of more than 400 known AI use cases, MGI found mundane business problems — supply chain, sales, and marketing — to be the most valuable use cases for AI. Value of AI by Use Case | Source: McKinsey Global Institute

Value of AI by Use Case | Source: McKinsey Global Institute

Value of AI across Industries

By mapping use cases to industries, MGI valued how important AI will be for various sectors. They found that industries with complex problems in top-line functions (such as sales) stand to gain the most from AI. Value of AI as % of Industry Revenues | Source: McKinsey Global Institute

Value of AI as % of Industry Revenues | Source: McKinsey Global Institute

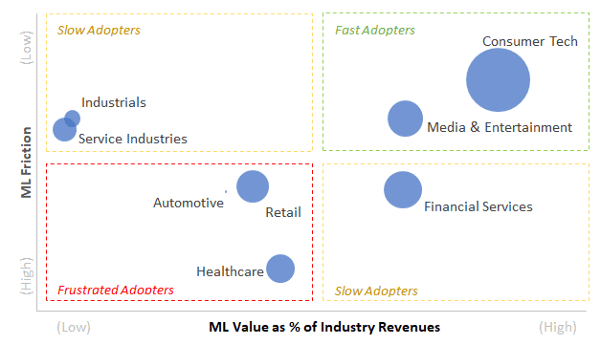

The Future of AI— Applying the Framework

So which industries are most vulnerable to slower-than-expected AI adoption? Who’s most likely to populate the graveyard of mistimed AI bets? This framework can be applied at the macro level to find out. I interviewed several AI experts to estimate how strong AI frictions are in each industry then aggregated and plotted this information against MGI’s AI value estimates: Based on my analysis, AI will roll out across industries in three waves:

Based on my analysis, AI will roll out across industries in three waves:

- 1st Wave AI — Fast Adopters: This wave, incorporating consumer tech and media, is already well underway. Advances by the likes of Google, Facebook, and Netflix are leading the charge.

- 2nd Wave AI — Slow Adopters: This wave, too, has already begun but is likely to roll out more slowly. Some adopters (such as manufacturers and supply chain operators) are less motivated to adopt AI. Others (such as banks) see huge payoffs if they succeed, but face significant challenges in adopting AI.

- 3rd Wave AI — Frustrated Adopters: Healthcare, automotive, and (possibly) retail are at risk of slower-than-hoped-for adoption of AI. All face huge obstacles to adopting AI. All, on a dollar-for-dollar basis, have less incentive to adopt AI. Note, however, that retail is a bit of a misfit here: traditional retailers face significant frictions in some areas (sales and marketing) but are fast adopters of AI in others (supply chain operations).

下载开源日报APP:https://openingsource.org/2579/

加入我们:https://openingsource.org/about/join/

关注我们:https://openingsource.org/about/love/